Saving the World: Dave’s Way or Mine?

A Torontonian named Dave Pollard writes an entry every day in his blog, “How to Save the World.” Another blogger, Hassan Masum, who writes at “Worldchanging.com” concluded that we three ought to meet and compare our schemes for fixing the world. Today we had lunch and talked about tax shifting, an important environmental measure, but not one on which I claim any expertise.

Dave and Hassan waded into the economics of the thing. It wasn’t controversial. The basic idea is to tax things that are socially or environmentally undesirable, but reduce or eliminate taxes on beneficial things such as employment. Impose taxes on waste and pollution, for example, but don’t tax wages. While most people would agree on this conceptually, not many people know how they would be affected in reality. The Scandinavian countries have already made bold moves in that direction and, more recently, Germany has moved far ahead too.

This is easier in a country with proportional representation, Dave explained. For example, the Greens picked up enough seats in parliament to be courted by some of the other parties. Naturally, they appointed a Green as minister of environment, and he introduced environmentally beneficial tax shifts. In North America, with our first-past-the-post electoral system, no such a thing can happen.

Mostly I sat listening and free associating. The Tobin Tax sprang to mind. And then it occurred to me that tax shifting was not a new idea. Henry George had promoted a version of it more than a century ago by proposing to tax land, not buildings. George was one of the most famous radicals of his day, but no Marxist. (He predicted, indeed, that any country that applied Marxism in practice would be vulnerable to dictatorship.)

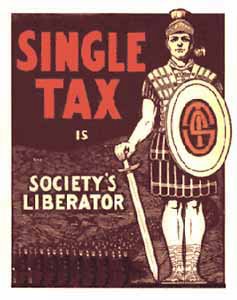

George was ahead of his time with his policy known as the “Single Tax.” (See photo.) As we all know, the value of a piece of real estate is determined by three things: its location, its location, and its location. George reasoned that the value of a piece of land is established by the community — the people who built other structures around it — and therefore that the community ought to share in the appreciation of value that they create. It makes sense to tax land according to its market value, not the buildings situated on it. As tax law exists now, my Georgist friend Jean Smith has explained to me, people waste land in the middle of town with vacant lots and outdoor parking, while erecting big homes in the sprawling suburbs and countryside. Taxing land would result in much more efficient, compact city plans, with greater incentive for owners to invest in the improvement of their buildings. At present in Canada, owners may be reluctant to renew their run-down properties because that will increase their property taxes. As the energy shortage worsens, we’re going to wish that we’d taxed land all along, for commuting will become prohibitive and millions of people will have to move back to the cities.

Dave and Hassan did not oppose my land taxation idea, but Dave seemed to have mixed feelings about compact cities. Then I learned what his misgivings were: He lives in the woods beyond suburbia, enjoying his solitude and the deer that frequent his back yard. My Georgist friend Jean also has a country place not far from him. This fact reminded me that not everyone will necessarily agree about which taxes to shift.

But I liked the conversation because it was not idle. Dave wanted us all to do something to get tax shifting legislation adopted. We need a strategy, he announced. I sat up taller, waiting to be told what part I should play.

Regrettably, I was skeptical about his approach. He would proceed by getting some university-based economists together to write up a specific proposal. Then he would go straight to meet with a government minister to convince him of the idea. No particular party has a unique commitment, so he wouldn’t try to make it a political issue. Go around the political parties. Go to the top officials, not the middle level bureaucrats, who cannot really do much and can’t entertain big ideas.

I asked: the minister of environment?

No, the minister of finance. Environmentalists don’t see the connection between the environment and taxes. They would say it’s none of their business. So do ordinary citizens. You can inform them about facts but you can’t get them interested in taxation policies.

I balked. That’s not how I go about pursuing social change. I believe that politicians can’t take action until they are pushed from below by NGOs. We need for ordinary citizens to call for tax shifting at the grass-roots level. Maybe even to march in the streets demanding it.

“But they don’t care,” Dave pointed out. “Even if you educate them it won’t make any difference.”

I agree. That’s where we have to start: by making people care. The problem is not their cognitive shortcomings, because they can know but still not act. It has to become an emotional matter.

Dave did not disagree, and when I began elaborating he nodded.

“Story-telling, yes,” he said.

“A drama,” I continued, “perhaps about some interesting guy who works in the ministry of environment and cares passionately about changing the tax system. If the viewers like him, his emotional commitment will become contagious.”

Dave started playing with my fantasy. We could go to Germany, he said, and interview people there who are able to do great things in their businesses nowadays because of the new shifts in their tax system.

On this angle, all three of us agreed, but we also recognized that we’re personally in no position to promote it much. Instead of producing TV shows, we’ll have to take a different approach, probably Dave’s initial route: gathering academic experts and pitching ideas to government officials.

But if you are an NGO craving participation in a grass-roots campaign to promote tax shifting, I can introduce you to some great new partners. Just give me a call.

2 Comments:

Metta, this is oversimplified. While I fully support taxing heavily for pollution, especially petroluem products, electricity production where it is subsidized, etc. But who pays for social costs: health care, welfare, criminal justice, etcetera. Those costs should still be borne by a wage-earning taxpayer.

On the other hand, raising pollution taxes to shift people to public transit makes alot of sense. Let's face it: our biggest immediate threats is global warming, nuclear catastrophies, and global destabilization.

Unfortunately, we've got a backwards government south of the border with their heads deep in the sand. And until a progressive solution from a new government who acknoledges the threats and deals with them intelligently, we're stuck in this time bomb we call Earth.

Peacemaker, I checked out the TOPS program's site, and it sounds fine. I don't think it's related to the tax shifting idea, though. I met Mitchell Gold for coffee once a long time ago and he said he wanted to do peacemaking that did not involve politics. I don't think that's possible.

And Tim, I'm not sure where we agree and disagree. You say you approve of pollution taxes. I don't think I said anything about shifting taxation away on matters of social costs. I don't have a clear opinion about it. But certainly things would get a lot easier if the Bush administration changed in the directions we would both prefer.

Post a Comment

<< Home